VAT Invoices

We'll automatically email you a VAT invoice (EU-compliant tax invoice) every time a transaction is completed.

If you provided us with a valid EU VAT number when you created your account it will be listed on all invoices. If you want to add your EU VAT number to an account that already exists let us know at support@zappar.com and we'll modify your account appropriately.

Invoice Details

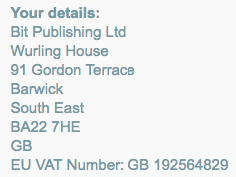

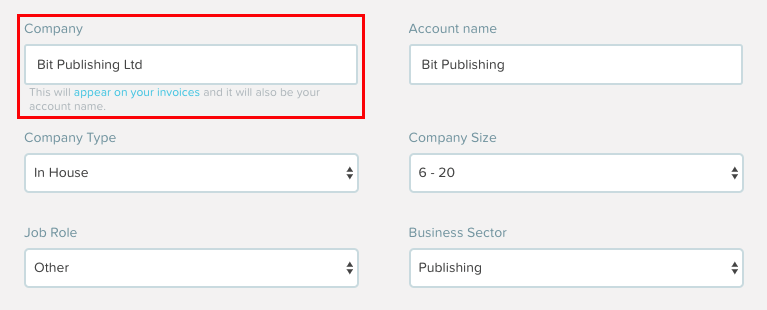

Account invoice details are generated as follows:

- Name

- The name at the top an account's invoice details (Bit Publishing Ltd in the example above) is populated from the Company field on the Account Settings page.

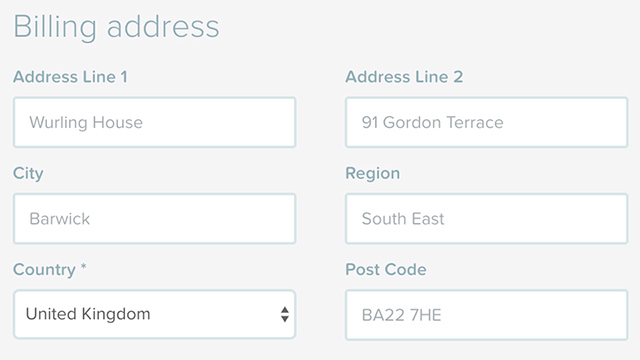

- Address

- The address following the name is populated from the Billing Address section of the payment card used to make the purchase.

- EU VAT number

- The EU VAT number is populated from the VAT Number field present during the payment process.

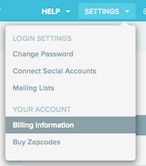

Resending Past Invoices

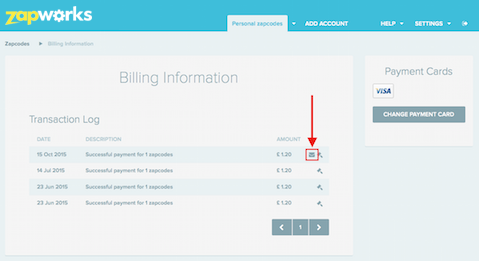

You can ask ZapWorks to resend past invoices from the Billing Information area. You can access this area from the Settings menu:

Click on the email icon next to an invoice you'd like resent:

It may take a little while for the email to arrive in your inbox. If it hasn't arrived after an hour, and it hasn't gone into your spam folder, drop us a line at support@zappar.com.